The majority of college students are barely making enough money to live off. This situation has gotten even worse, due to the cost of living and soaring inflation. It will take financial knowledge to be able to maneuver the transition into adulthood as successfully as we can.

Currently, most California high schools don’t teach financial literacy, which is a big issue. Mainly, because financial literacy is the most beneficial knowledge we can have in adulthood, especially when living in the 2nd most expensive U.S. state.

Financial literacy is the knowledge and skills that help an individual better understand finances and make informed decisions when it comes to money. This includes managing debt, saving money, investing, and budgeting. All these skills are useful in adulthood, yet most schools don’t provide this class. Instead, most high schools choose to lightly embed personal financial literacy into current curriculums that don’t get as in-depth as most students would like.

“We watch videos that have to do with it, so I feel like I have a basic understanding of it,” senior Alexa Torres said. “But, it’s up to the students if they want to grasp a better understanding of financial literacy.”

Gov/Econ is an A through G requirement at our school, but it looks at the wider lens of finances, as it just teaches the basics. To become more educated, taking a class that is focused on financial literacy gets more into the specific situations that students might find themselves in is necessary—for example, filing taxes, bill payments, checking and savings accounts, and credit.

Since taking a financial literacy course isn’t required in our state, many freshmen college students are often making amateur mistakes when it comes to finances when instead, they could be entering adulthood well-prepared.

There are many ways in which financial literacy can help us prepare for adulthood. For example, many high-school students often contemplate if they should buy, rent, live on campus, or even buy a mobile home when they transfer to their desired university. But, if you become financially literate, choices like that become clearer, especially because you would be taught by someone who went through the same thing. Not only that, but many high-school and college students who work, often believe that the idea of saving up for retirement because it’s so “far away” isn’t needed. So instead of doing so, they spend that money on things like clothes, concerts, and activities. This isn’t necessarily bad, but taking a financial literacy class can teach us that there’s a better way to spend our money, and where that money should be put towards.

Financial literacy helps us understand how to manage debt. Student debt troubles most adults, especially if they attended a prestigious university. In California, the average student loan debt is almost 40 thousand dollars. With debt that high, it’s necessary to be taught how to successfully manage any accumulated debt, so it doesn’t consume our lives like it does most Americans.

Financial Literacy teaches us how to save our money. It is no lie that many young adults spend their money on unnecessary purchases. By doing this, they are not putting aside money in their savings. If a sudden incident ever were to happen. For example, a family emergency, or their car breaking down. It is important to have money put aside to resolve the issue, without pulling from the money needed for basic living costs. Sadly, most students won’t take saving seriously, because they never had a trustworthy mentor to tell them how beneficial it is.

Even with its benefits, only 25 states require students to take a financial literacy course. Unfortunately, California isn’t one of those states. It is one of only four states that have no financial literacy requirements at all.

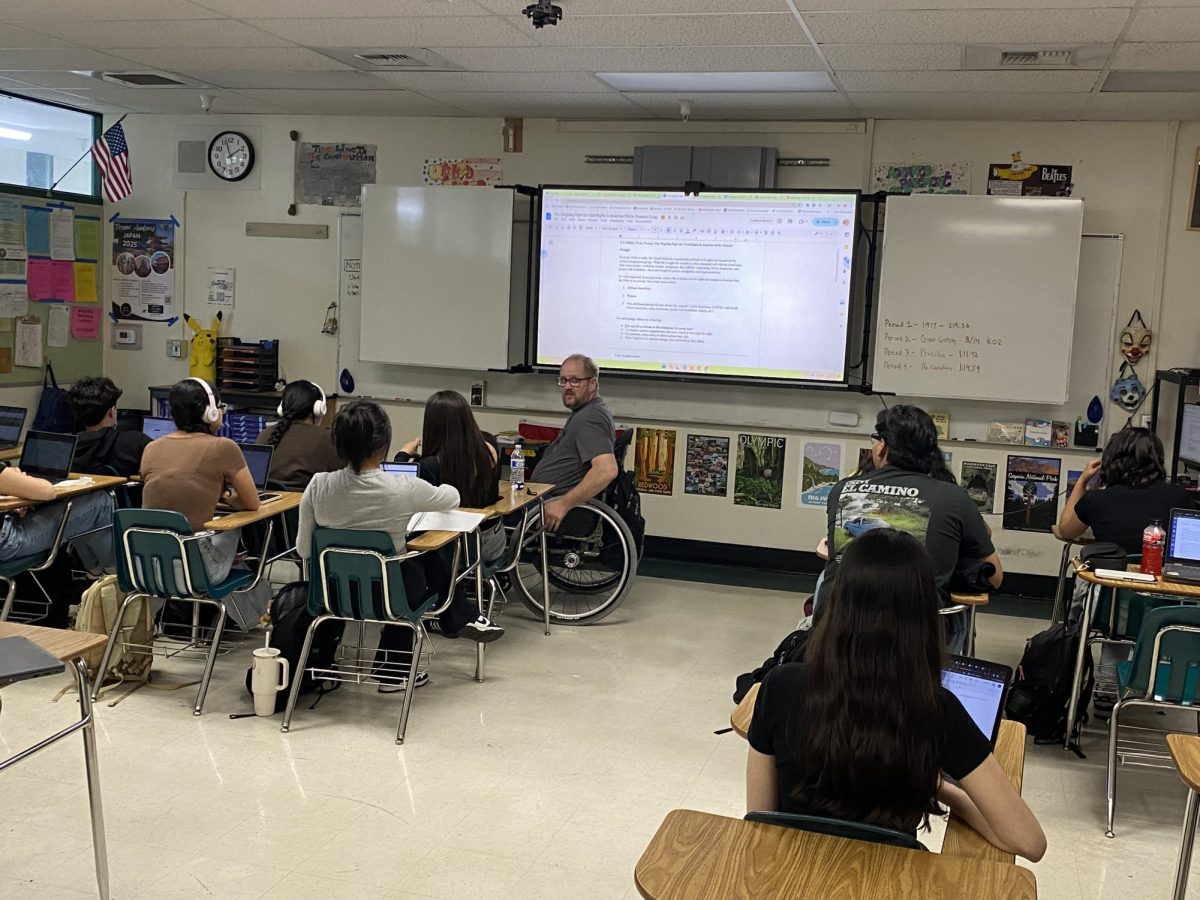

At Alisal, we have semester classes, like ethnic studies and health. Why not add financial literacy? “It comes down to having a teacher who would teach it, and students who are interested,” counselor Sandra Echevarria said. I believe that the introduction of this class would benefit every student who takes it, especially if it’s offered the semester before graduation.

At this moment, most seniors are currently deciding where they should attend college, while most juniors are currently browsing their options. With my situation, I am going to a university that isn’t going to cost me an arm and a leg and I know that’s the same with others too.

“Students are concerned about how they are going to pay for their education, those are the types of conversations that I’ve had with my students,” Echevarria said.

The worry is well-justified because big-name universities are extremely costly, and most students don’t have much financial knowledge. Some students are offered financial aid. But, no matter your situation, it’s necessary to get educated on the cost of housing, transportation, materials, etc.

There are opportunities for students to get educated on the matter, but it’s mainly through online programs, like EVERFI and even the California Department of Education’s website. Yes, even the California Department of Education is aware of the need for financial education, but nothing has been made official.

For a financial literacy requirement to become official, it will take cooperation from California residents. Right now, Tim Ranzetta is gathering signatures for an initiative to be put on the ballot. For this to happen, nine hundred thousand signatures were needed, and Ranzetta gathered almost all of the necessary signatures. Once it is put into legislation, financial literacy (in any form) becomes a statewide requirement.

In the meantime, our school can still implement this course. So if we want this change and the preparation needed to set us up for real-world success, we need to express our interest in taking this course. Doing so will not only help us incorporate financial literacy at our school, but in other California high schools as well. Until then, check out either of the links above to learn what you need to know about personal finance.